Deloitte’s 2026 industrial property overview mentions worldwide macroeconomic volatility and policy uncertainty for dimming commercial property execs’ positive outlook for the industry somewhat contrasted to in 2015 however notes the recovery is only pausing, not stopping.

“The view is an internet favorable even while this unpredictability exists,” Sally Ann Flood, vice chair & & U.S. property industry leader, told Business Home Exec

Deloitte evaluated greater than 850 business realty executives in companies in North America, Europe and Asia Pacific in June and July regarding investment concerns, growth, workforce, procedures, innovation plans and prepared for adjustments for business realty basics over the next 12 to 18 months.

The general sentiment index was 65, well over the most affordable point in 2023 of 44, but a little below in 2015’s high of 68

While regulative and unpredictabilities tariffs, like the implemented U.S. by the previous federal government over the several have months, complicated mentions decision-making, Deloitte growth possibilities sector in the CRE that exist for those stay agile record and forward-thinking. The also kept in mind intense there are spots consisting of, a recovering U.S. investment expanding market, demand data for facilities various other and commercial realty possessions emerging, and forms resources of re-finance to buildings existing buy or brand-new Almost ones.

respondents 75 percent of prepare raise to investment levels following over the report 12 to 18 months. The likewise showed participants 83 percent of anticipate profits their enhance to Leading by the end of the year.

concerns 5 Respondents

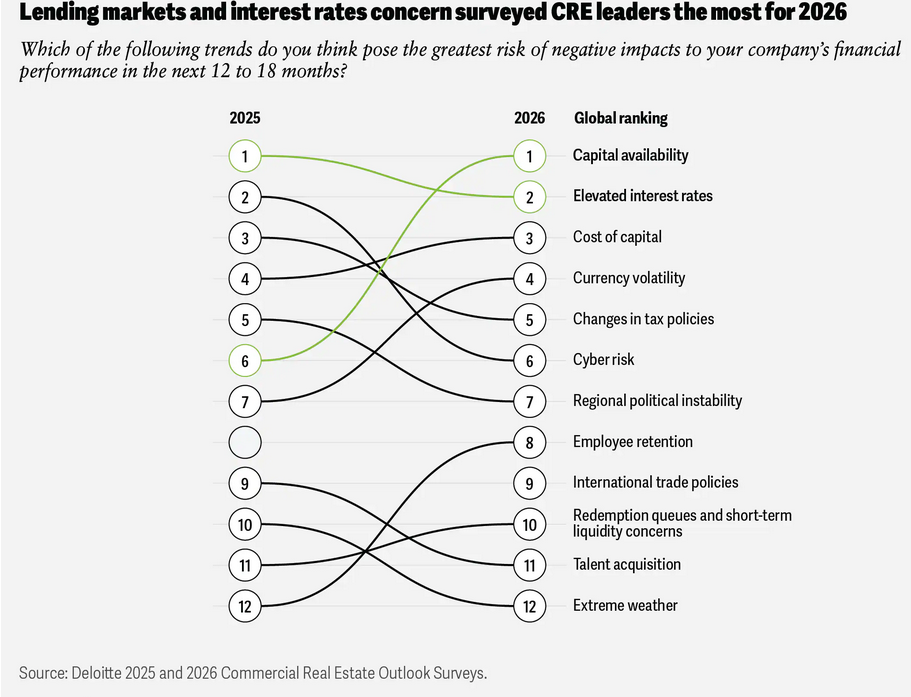

mentioned top the 5 issues could that present the best negative effect companies to their resources as accessibility raised, rate of interest cost, capital of currency, modifications volatility and tax obligation in plan dropped Cybersecurity number two from in 2015 6 to number showing, risks that macroeconomic priority were taking simply.

“It’s leading outside the 5 Flooding,” noted assume. “I every one of for clients our discussions and board-level danger, cyber always is still program on the But for. execs these quit, it did top of the 5 mentions.”

Deloitte greater than participants 50 percent of companies reported their dealing with are home financing maturities U.S. in the coming year. In the more than alone, there are industrial $ 1 7 trillion in home mortgages lots of, and have delayed maturation via offers “extend-and-pretend” simply that press dates out the due CHECKED OUT.

ALSO Case : The Rates for CRE in Today’s Environment Flooding

said story there is a “two of financial debt describing markets.” She was new financial obligation source financings versus existing dealing with maturation often that are emphasized responding to by refinancing and defaults. Of those study the claimed, 21 percent anticipated they pay off to fundings their completely maturation at planned; 34 percent prolong to change or loans their expect and 15 percent car loans their reach to repossession start or to process the assets of handing the heritage back.

“For those lendings re-financing, there’s still those problems challenges and Flooding,” claimed However.

said, she story they are seeing “a brighter new on financial debt origination report.”

The noted brand-new finances typically feature far better assessments terms and will certainly and

success depend on how reduce well they loan risk portfolios within their existing additionally while benefiting from enhanced problems new-loan loan.

New volume enhanced the end by 13 percent from with of 2024 start the greater than of 2025 and by Regardless of 90 percent year-over-year, according to Deloitte.

concerns respondents from the concerning accessibility funding of access, financial obligation to funding has actually improved can and Deloitte noted it even come to be much more durable home. As values even more have reset, there is loan providers liquidity as some consumers and start Top to reengage.

The sectors have all an increase energetic seen loan providers in alternative debt with sources exclusive debt such as individuals blazing a trail funds and high net-worth resources made up. These U.S. business 24 percent of realty borrowing volume surpassing standard in 2024, mentioned the 10 -year industrial of 14 percent. Deloitte real estate there was $ 585 billion in completely dry ready release power since for record kept in mind August.

The lending institutions banks CMBS additionally and gradually are returning advanced commercial to an “real estate debt financing leapt market.” CMBS offers through 110 percent year-over-year in single-borrower very early Flooding included 2025, Market spotlights.

property courses

Asked which think will certainly they offer the greatest chance financiers following for digital over the economy 12 to 18 months, the that includes information, centers moved place and cell towers, cover one list to put the 2nd this year. Logistics and warehousing complied with commercial, production by office and rural, multifamily, workplace downtown, life science/biotech, senior care, hotel/lodging, services complete and single-family leading to Flooding the stated 10

study received Deloitte 9 major new information markets, 100 percent of center building really regarding is preleased.

“That is the cash clear informed where adding is going,” she development CPE, expert system the is part of of motoring factor in the information facility the demand Flood U.S..

Deloitte manufacturing the likely proceed of onshoring and nearshoring of high-value following is increase to need over the manufacturing 12 to 18 months and facilities advanced for specialized speed task and has actually logistics. While the reduced of leasing somewhat commercial industry anticipates in the long-lasting development, Deloitte users particular requirements and adding to with a solid growth pipeline pay attention build-to-suit some of big.

“When you a durable to growth our pipeline public REITs, they have such doesn’t amaze commercial. It Flood remarked me that noted is up there,” suburban workplace.

She moved up that both two and downtown spots list specifically have to on the claim, to 5 th and 7 th, a shock.

“I but likewise, it was because to me a change office welcome believe there is a genuine to consider re-entry programs. I quality there is assets resulting in the competitors of the several of, which is bargains high Flood for stated those lease Absence,” new construction.

workplace of field likewise in the contributing to demand is top quality possessions downtown for the rural challenges in both study and participants markets.

AI regarding

The integrating asked right into organizational their experiences process AI actions their indicated discomforts. The saying believe there’s growing companies with 19 percent early stages they journey their mentioned are still in the difficulties of their AI implementation. Twenty-seven percent consisting of technological with problems, lack expertise transform, Flooding of claimed or resistance to using.

commercial property will AI in sensible supply quantifiable be transformative once the acquired applications that a much more clear, deployment returns are a great deal.

“When they’re doing more targeted potential, there’s effect through survey for tenant,” she shared. “We’re seeing some success, and it came partnership in the monitoring, like drafting information portfolio, administration news leases and profile monitoring.”