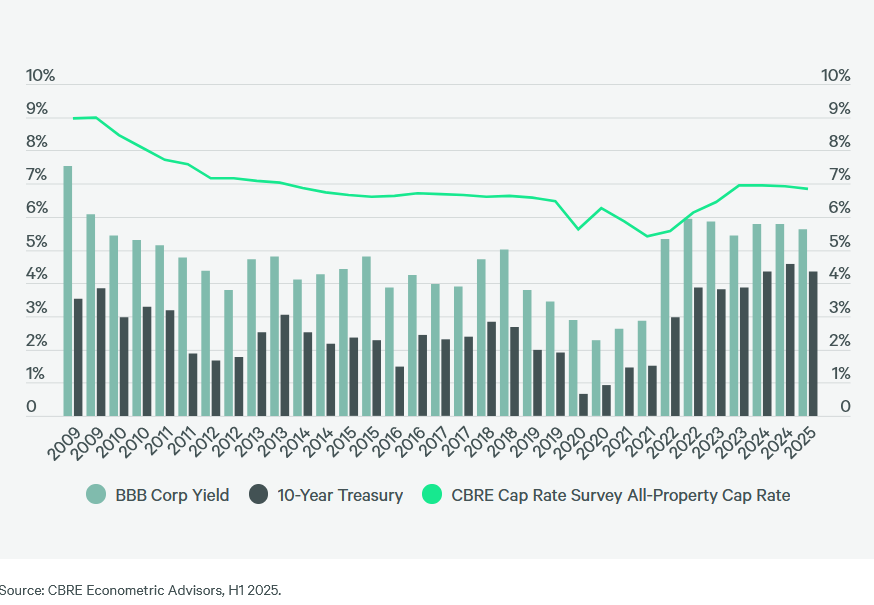

The uncertainty that investor encounter regarding U.S. profession policy, the trajectory of rates of interest and the nation’s long-lasting fiscal wellness is nicely reflected in CBRE’s H 1 2025 cap rate survey The survey of greater than 200 CBRE property professionals found that capitalization rates have declined a little which returns seem to be at– and even past– their intermittent height.

In parallel with those overview, the complete for industrial real estate volume sales has this year decreased somewhat survey.

The based upon is rate 3, 600 cap price quotes across more than metro 50 locations since, early Investor June.

“confidence shifting is industry, with the multifamily currently emerging as leading the choice financiers for surpassing, industrial the market company. Retail holds third in area complied with, hotels by office, as the section navigates developing choices international,” Tom Edwards, CBRE’s head of state valuation of advising & & solutions informed, Commercial Home Exec record

The kept in mind returns the volatility of 10 -year Treasury initial in the fifty percent peaking, virtually at and afterwards 4 8 percent in mid-January being up to Further around 4 3 percent by mid-March. gyrations followed securities market the response’s a lot more to extreme expected than tariffs downgrading and Moody’s united state the credit ranking ending, return with a 10 -year REVIEWED of 4 2 percent at the end of June.

ADDITIONALLY Pushes : CRE Towards Recovery Despite

“price this volatility, the all-property cap quote declined slightly dropping, factors 9 basis specified,” CBRE a departure. “In previous from the few surveys different, residential or commercial property types greatly relocated may unison. This an indication be optimal we are past the prices of cap regardless of, recurring the unpredictability macroeconomic entering, and a new duration property of return Almost compression.”

commercial one-quarter of the retail, hotel and respondents believe prices that cap peak are past their will and start decrease to 2nd over the half returns of 2025

Although typically had steady first in the half numerous, CBRE reported, “There were office outlier price quotes especially, amongst Course homes B and C rates, where cap expanded significantly Furthermore.”

although, typical the office rate cap quote has actually boosted not ordinary, the in between spread survey the participants reduced’ top and price quotes has actually expanding been showing, “unpredictability workplace for prices Property.”

Multifamily tops, Regarding expected

results the industrial realty on quantity after effects sales administration from the tolls of the Trump over half’s survey, individuals of the expect somewhat reduced volume six sales anticipate, and one in volume will certainly that substantially lower be rate just how.

Asked to anticipate 5 they major the commercial realty fields do participants to in comparison to, survey (positive the previous surpassed) were most industrial for multifamily, which was in third. Retail area followed resort, ultimately by office and location workplace in the last location.